Is Python the right programming language for Insurance?

10 minutes

From creating pricing models to unlocking Machine Learning, learn about the practical applications of Python in Insurance and how it stacks up against the competition

Despite dragging it’s feet on modernisation, the insurance sector is increasingly adopting programming languages to streamline workflows and enhance decision-making capabilities. Among these languages, Python has emerged as one of the leading options for forward-thinking insurers and actuaries.

Whether you're an actuary seeking to upgrade your skills or an insurer aiming to optimize your operations, this blog is your essential roadmap to understanding and leveraging the transformative potential of Python in the insurance industry.

Skip to...

What is the most popular programming language for insurance?

The TIOBE organization checks more than 1 billion lines of software code worldwide, in real-time, every day, to determine the popularity of programming languages. Following a strong upward trajectory since 2018, Python has been #1 since late 2021, with C a close #2.

What about the popularity of languages used in actuarial work? hyperexponential conducted a poll at an event for actuaries representing 15 independent companies. Participants were invited to rank six options according to how frequently they use each language.

Visual Basic came in first, reflecting the cohort’s considerable expertise with Excel, followed by Python. R came in third, reflecting it's strong history in insurance and academic circles.

An emerging talent pool

In 2014, England became the first country to make teaching coding to children mandatory at both primary and secondary school level. Teenagers are introduced to both JavaScript and Python.

This trend carries on through to higher education. Anyone who graduated with an actuarial-related degree in the last ten years will have had a programming element in their course. Looking at the London School of Economics' Actuarial Science BSc, first years are picking up Programming for Data Science, which focuses on—you guessed it: Python.

The importance of coding skills for actuaries

Developing skills in a programming language has measurable benefits for actuaries, including:

Owning the entire workflow

Coding skills allow actuaries to position themselves as valuable contributors within their organizations. They can own more of their workflow, taking the lead in developing and implementing models from beginning to end.

This newfound autonomy and influence not only elevates the actuarial role within an organization, but also enhances the overall efficiency and effectiveness of their work.

Stay competitive with marketable, transferable skills

Coding skills are increasingly less of a ‘nice to have’, and more of a fundamental requirement to be competitive in the job marketplace. Programming skills are also hugely transferable across teams and sectors, creating new opportunities.

Staying ahead of the curve is always a good idea. Actuaries who take the time to learn the fundamentals of machine learning, AI, and other emerging technologies now are likely to find themselves ever-more hirable in the years to come.

Learn something rewarding and engaging

Learning programming languages can be very enjoyable, especially for analytical problem-solvers– traits that describe almost every actuary! It's a common journey: many start coding for work and soon find themselves diving into personal projects during their free time.

5 reasons to use Python for insurance

Python is uniquely suited for the complex, dynamic insurance industry—and here are five reasons why.

1.) Readable and approachable

One of Python's most significant advantages is its readability. With a fairly light syntax that closely resembles English, Python is approachable for beginners. This inherent simplicity enables a faster and more intuitive learning curve compared to other languages.

2.) Versatile and scalable

Python’s adaptability makes it a particularly strong language for insurance, where each company and team face unique challenges and require custom solutions.

Insurers can leverage Python across their organisation, from enabling stronger reporting to unlocking the potential for cloud computing. The language can be leveraged to transform every step of the pricing workflow, including:

Building and maintaining pricing models: Creating and maintaining more accurate, dynamic models that adapt to changing market conditions and regulatory requirements.

Python supports a modular approach. Modules allow large, complex problems to be broken into manageable units, leading to better organized and more maintainable code.

For actuaries, this means the complex insurance models hey are creating can be developed, tested, and maintained more efficiently and accurately.

Analysing rich, live data: Collecting, processing, and creating insight from data to drive informed decision-making.

Automating processes: Because of its huge range of open source packages, Python can automate a wide variety of time-consuming tasks like data manipulation, integration with other systems, and document generation etc. This automation accelerates these processes and frees up insurance professionals to focus on higher-value work, improving overall productivity, while reducing the risk of human error.

It’s a true end-to-end solution for the insurance industry.

3.) Ease of integration

One of the primary reasons Python stands out as a strong choice for the insurance sector is its remarkable ability to integrate seamlessly with existing and new systems.

Streamline workflows and enrich decision-making

Collating, ingesting, and manipulating data manually takes up a huge amount of time and resource. Insurers need to leverage technology that can support data management and processing, freeing up their actuaries and underwriters to focus on analysis and making stronger data-driven decisions.

With the heavily used requests package, Python is great at supporting API connections. That means, with the right Python-based solution, insurers can effortlessly ingest data from a plethora of external sources. This includes internal and external databases, and even unstructured data collected through web scraping from various platforms like Companies House and Google Maps. The ability to create seamless integrations with Policy Admin Systems (PAS) and other platforms helps to eliminate re-keying.

Furthermore, the insurance industry often grapples with the challenge of integrating legacy systems into modern technical environments. Python's versatility and its ability to interface with other programming languages and technologies make it an ideal choice for this task.

It can act as a bridge between the old and new, facilitating a smoother transition to a more advanced technical ecosystem without disrupting existing operations.

Unlock new opportunities

Times change, and so do insurance tech stacks. Building new systems into pricing workflows with Python is easy, enabling insurance companies to adopt innovative technologies swiftly and stay ahead of the curve.

4.) Engaged community and extensive library support

The ubiquity of Python creates some key benefits for actuaries and insurers. Whether it’s leveraging the wide array of libraries or seeking guidance from forums, support is always at hand.

Development and training for Python is widely accessible

Actuaries who haven’t learned Python in their formal education can quickly catch up. There is an abundance of free and paid educational materials available online, ranging from introductory courses to advanced tutorials.

From forums and discussion boards to conferences and meetups, there are also many platforms for actuaries to connect with other Python enthusiasts, share insights, and collaboratively solve problems.

Python tools and libraries for insurance

The language's open-source nature has led to the creation of a rich ecosystem of libraries specifically tailored for various tasks. For actuaries, libraries like SciPy, NumPy, Pandas, Matplotlib and Plotly are particularly beneficial.

SciPy: Actuaries leverage SciPy for risk modeling, simulation, and complex mathematical analysis, ensuring precise calculations essential for insurance pricing, reserving, and risk management.

NumPy: Actuaries use NumPy for numerical and scientific computation and the streamlined manipulation of large datasets.

Pandas: Pandas is a data manipulation library. Actuaries use it to more easily organize and preprocess diverse datasets, ensure data integrity and enable the comprehensive analysis crucial to informed insurance risk assessment and decision-making.

Matplotlib and Plotly: Everyone loves a graph. These libraries allow actuaries to create interactive and appealing charts and graphs—making it easier to spot trends, identify patterns, and communicate actuarial findings effectively.

5.) Future-proof

Python isn't only an efficient, powerful choice for now; it also helps actuaries and insurers prepare for the future.

Compliant, updated models

Pricing models built in Python by actuaries can be easily developed, scaled-up, corrected and improved over time. No outdated, restrictive low-code solutions that are falling behind the rapidly changing sector, no battling with overstretched super-spreadsheets; just endless room to grow.

Bigger talent pool

With Python being the most popular language in the world, nearly all developers worth their salt will have experience and actively seek out opportunities to flex their skills. This means a more competitive recruitment market and easy access to high quality talent in your recruitment efforts. Hiring developers for dead languages is no easy task.

Python and machine learning for insurance

Machine Learning (ML) is often touted as the next great frontier in insurance. Many are excited about the possibilities for lightning-fast workflows, more accurate models, and ultimately greater business success.

Python supports ML because:

It is an excellent tool for creating and maintaining a clean, rich pool of data. This is the ideal environment for supporting the implementation of ML.

Python is the language of choice for many machine learning developments. This means, for teams already adept with Python, innovation outside the organization and even industry can be used to accelerate ML adoption and unlock the benefits sooner.

Trying to build something from scratch in languages with less ML development, such as C#, would be exponentially more challenging and resource intensive.

"Phillipe has ambitious plans for Rising Edge over the next five years, and we believe hx Renew is well-positioned to help us achieve them. Python, the programming language Renew uses, enables artificial intelligence, data cleansing, and more. As hx evolves, we'll be able to leverage AI to improve our models to something futuristic and deliver all our ambitious goals."

David Hughes, Mulberry Risk Founder

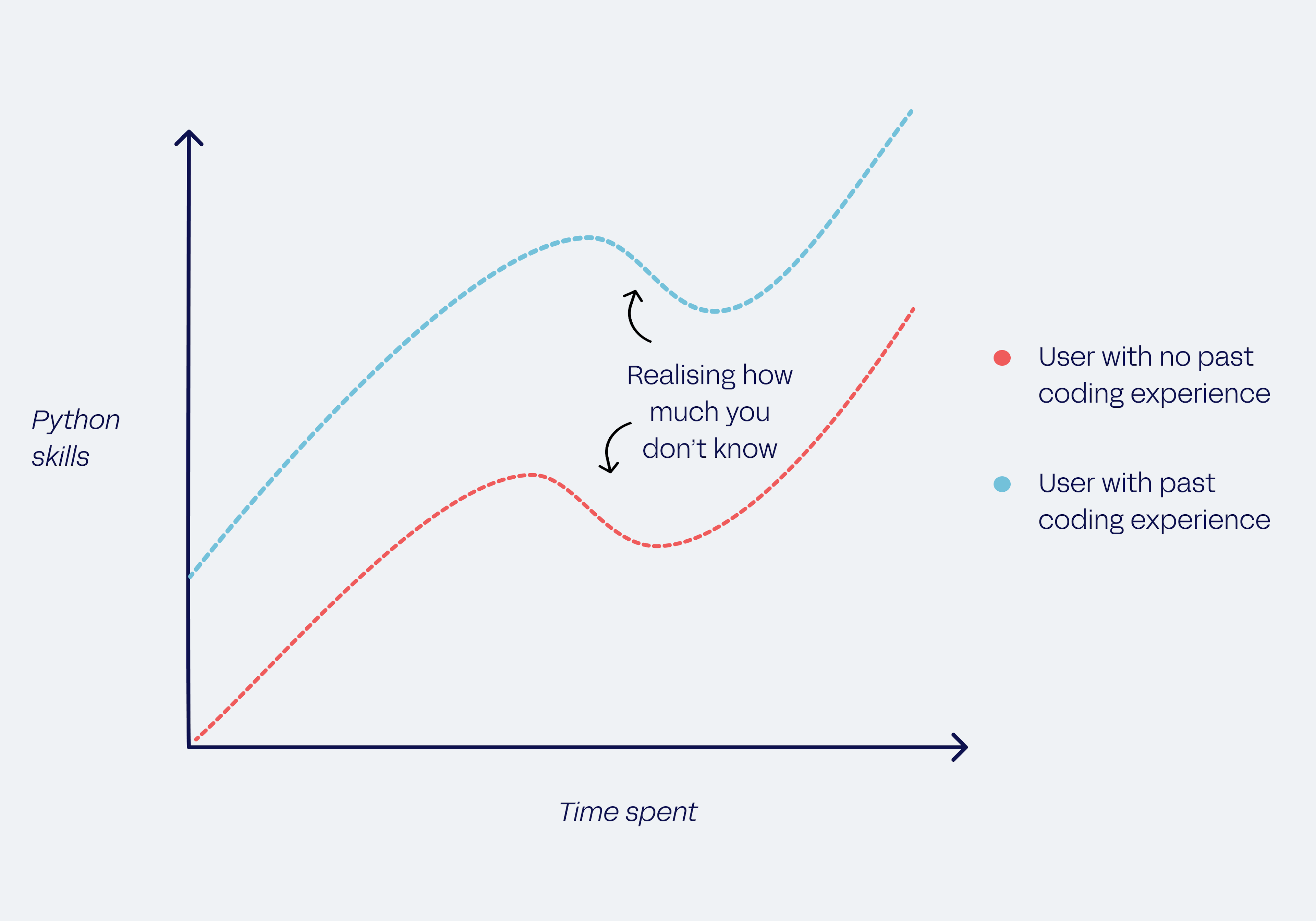

What is the learning curve for actuaries using Python?

Given all the many and varied applications discussed in this blog, the relative simplicity of learning Python may come as something of a surprise. After just a few days of training actuaries can build their first, straightforward practice models, and within weeks and months start developing models and policies faster than ever before.

The learning curve is especially shallow for actuaries who have had some exposure to coding. Any level of experience with R, C#, or VBA will translate well to programming with Python.

Next steps

After the functional knowledge required for their role requirements, a commitment to continued learning will unlock new challenges, and new possibilities!

Python’s flexibility and community-driven development means there are always new things to learn, build, and improve. This helps keep actuaries (and the organizations they work for) at the forefront of technological advancements in their field.

How does Python compare to other languages for insurance?

Python is a popular choice for insurance, but it's far from the only one. How does it stack up against other programming languages?

Python vs R for actuaries

For many actuaries, R will be the first coding language they encountered. It’s a common choice for insurers, and there are many reasons why:

R was specifically designed for statistical data analysis, and as such, offers a rich set of packages for statistical modeling

It’s also a strong choice for data visualization, with packages like ggplot2.

The widespread adoption of R in insurance and its integral role in actuarial qualifications have led to widespread familiarity among professionals. This familiarity results in a dedicated talent pool, making it easier for firms to recruit and integrate skilled actuaries well-versed in R.

That said, there are strong reasons insurers at the industry's cutting-edge are increasingly choosing to invest in Python.

Pricing transformation: R is a strong choice for data analysis, as is Python. However, Python also covers a far broader range of applications. Actuaries who know Python can go well beyond crunching numbers; Python adeptly handles tasks from data collection to model deployment, automating manual entry to rolling out policy updates.

More community and collaboration: Python is by far more commonly used outside of the insurance industry, and therefore offers a much richer selection of non-statistical resources and communities. It is also considered easier to learn than R because of its more straightforward syntax and wider range of online courses, communities and support..

Non-actuarial departments, such as IT, are more likely to be familiar with Python than R. A common coding language can help drive effective inter-team cooperation.

Performance: While its performance has improved recently, R can sometimes lag when dealing with the large datasets that many insurers use. Python is known for its scalability and performance, particularly when integrated with other languages and tools. The ability to handle large-scale data processing makes Python a strong candidate for insurance applications involving big data.

Overall, while R is a strong choice for statistical analysis and a few extensions beyond this, Python can do everything R can do and unlocks more opportunities both for actuaries and insurers.

Python vs low/no code solutions for actuaries

Low/no-code platforms offer some important benefits, including:

Minimal entry barriers, allowing actuaries to initiate projects swiftly without extensive training.

A restricted environment that minimizes the risk of errors common in traditional coding.

Reducing reduce the need for professional development resources

However, this simplicity comes with inherent limitations.

Dependence on external support: Low/no-code platforms often require extensive reliance on IT support and third-party solutions. This can make workflows sluggish, as actuaries must often wait for external help to resolve platform limitations or bugs.

Complex issues don’t get easier with simpler solutions: When you need to solve a complex problem, there is a risk of over-simplifying the problem or getting into a huge mess with some no-code solutions, sometimes often requiring additional tools to support the process. Python encourages clean code and maintainable code design which can sit across multiple different systems. Toy xylophones are great but sometimes when you’re composing a masterpiece, you need a grand piano.

Limited compatibility: Integrating low/no-code platforms with existing systems and data sources is often a challenge. Many of these platforms work in silos, struggling to communicate with other software or databases effectively. This limitation can be a significant hindrance in actuarial work, which often requires data from varied sources to be synthesized and analyzed cohesively.

Scalability constraints: As the demands of a project grow, low/no-code solutions platforms may lack the flexibility and robustness needed to scale up without significant restructuring or even complete migration to a more capable platform.

Missing upskilling opportunities: One of the critical aspects of low/no-code platforms is their drag-and-drop interface, which, while user-friendly, offers little in terms of skill development. Actuaries, who are often inclined towards technical subjects, gain little knowledge or experience from using these simplified tools.

Python vs C # for actuaries

Less of a mainstream choice for actuaries than Python or R, C# has some notable strengths:

C# is highly efficient, especially in handling complex calculations and large-scale data processing.

For actuaries working extensively with Microsoft products, C# seamlessly integrates with the .NET framework.

C# and Python are both high-level, object-oriented languages, although C# is typically considered more complex for beginners. This can make the initial learning curve steeper, especially for those without a strong background in programming. Less common in the insurance industry, there is a correspondingly shallower pool of existing talent.

More focused on building robust, large-scale applications, particularly within the Microsoft ecosystem, C# does not offer the same level of flexibility as Python for varying insurance industry needs.

Overall, C# is a popular general programing language. However, it is unlikely to be needed in actuarial roles outside of highly specific use cases, or in most insurance companies.

Python vs Julia for actuaries

Julia is new but gaining attention. It aims to offer all the readability of Python but with better performance.

While Julia excels in high-performance computing and numerical analysis, it hasn't achieved the same level of mainstream adoption as Python. It’s unlikely to be the choice for actuaries or insurers today, but perhaps one to watch for the future!

Python vs C++ for actuaries

C++ is a low-level or more 'machine-friendly’ language, closer to machine code, compared to higher level, ‘people-friendly’ languages such as Python.

While a strong choice in other contexts, C++ is going to be too steep a learning curve, too slow, and ultimately unnecessary for the majority of actuaries.

Python vs VBA for actuaries

A focus on VBA suggests a reliance on Excel, which is increasingly viewed as too limited, fragile and ungovernable for actuarial work and pricing model development. Python symbolizes a transition to a more robust, dynamic methodology, aligning with the evolving landscape of the insurance industry.

Python vs SQL for actuaries

'Python vs SQL’ may be a little misleading, as the two languages serve different purposes and are often used in tandem.

SQL is the go-to language for database management. It allows actuaries to efficiently extract, update, and manipulate data stored in relational databases. For actuaries dealing with large volumes of data, SQL's ability to quickly and accurately query databases is indispensable.

It’s less broad in its application than Python but will still be helpful or necessary for most actuaries throughout their careers.

For those just starting out and wondering where to begin, the practical advice is to focus on mastering either language first depending on what is best aligned with your immediate needs. Once comfortable with one, expand to the other.

This sequential approach allows for a deeper understanding and better integration of both languages into your actuarial skillset.

How can actuaries get started with Python?

With the right resources and a structured approach, mastering Python can be both very achievable and highly rewarding. Here are some key tips to guide this learning journey:

1.) Take advantage of online resources

Some skills need to be learned on the job—Python is not one of them. There are countless resources available for everyone from absolute beginners to advanced programmers.

These range from free or partially free platforms like Udemy and YouTube to more structured, certified courses offered by Datacamp and Udacity. While the former can be great for supplemental learning or getting a feel for the language, the latter tends to provide a quality-assured product with a more comprehensive curriculum. Many insurers are happy to help with the cost. If there isn’t an established route in your organization, consider making a business case that reflects the measurable impacts of Python for insurers, and for you as an actuary.

A strong written resource that provides “a broad and less technical treatment of key topics in statistical learning”, including labs, can be found here: Introduction to Statistical Learning with applications in Python

2.) Leverage training opportunities

Actuaries in organizations that use hx Renew can benefit from a suite of training resources and expert-led courses. Our Python for Insurance course is great for complete beginners, or those looking to translate existing VBA or R skills into coding with Python. There’s also the opportunity for actuaries to become certified.

I’d never used Python before, but after the two-day training course and with the ongoing support from the hyperexponential team, it was quick and easy to get started with building in hx Renew”

Twinkle Popat – Senior Pricing Analyst at Aviva

3.) Get hands-on experience

The key to mastering Python is consistent practice and application. Engaging in real-world projects, whether at work or through personal ventures, helps solidify understanding and skills. Applying Python to solve actual problems or automate tasks in your daily work can be incredibly effective for reinforcing learning.

4.) Stay involved

Learning Python is an ongoing journey. Participating in in-person or streamed training webinars and events, such as those offered by organizations like hyperexponential, can be invaluable. These events provide great learning opportunities and offer a platform to network with peers and stay abreast of the latest trends and best practices in Python for insurance.

Ready to discover how Python can drive business success?

Python doesn’t just enhance processes—it can be used to unlock new opportunities and keep insurers at the forefront of the market. Highly versatile, quick to learn, with flexible integrations, it is the modern coding language best suited to insurance and actuarial work.

To discover how Python could transform your organization and workflows, get in touch with our experts here.