hx Renew for underwriters: Optimized workflows and data driven decision-making

9 minutes

Learn how underwriters spend less time rekeying data and more time making profitable pricing decisions with hx Renew.

In a rapidly changing risk landscape, it's key that insurers are able to react and take advantage of market opportunities. hx Renew unlocks best-in-class underwriting workflows that accelerate the pricing process, enable more informed decision-making, and ultimately drive business success.

Discover five ways hx Renew is enabling more profitable underwriting at leading insurers across the globe.

1. Eliminating rekeying so underwriters can focus on value added work

The average underwriter spends more than half the working week rekeying data into multiple internal systems. A significant amount of this time is spent gathering relevant customer data (both structured and unstructured) from 3rd party sources and entering it into the pricing tool.

The impact of all this manual effort reverberates throughout the pricing process. It means longer quote times, and effort spent on admin rather than more fulfilling value-added tasks such as risk selection, pricing negotiations, and customer/broker relationship management.

Transform underwriting workflows with hx Renew

hx Renew seamlessly integrates with internal systems and underwriter workbenches, eliminating rekeying of data between policy admin systems (PAS) and pricing tools and slashing quote times.

The platform also automates the gathering of third-party data. Structured data can be instantly accessed via APIs and pulled into hx Renew at the click of a button. In the absence of APIs and clean data sources, unstructured data can be collected through web scaping.

This eliminates the need for lengthy searches and repetitive data collection. Processes which would have taken hours per risk can now be completed in seconds.

“In the past, underwriters had many manual tasks, including weekly reporting; hx Renew takes away the administrative burden, freeing up more of their time to focus on pricing.”

Stephen Baker, Antares Project Manager

hx Renew's APIs also enable insurers and reinsurers to automatically upload submissions from other systems, generating a technical price before an underwriter ever touches the model. This further reduces the time it takes for underwriters to respond to their trading partners.

Seamless integrations that flex with your organization

Times change, and so do insurer’s tech stacks. hx Renew is a flexible system proven to support multiple types of integration.

This makes it a future-proof option as your organizational and workflow requirements evolve. One platform, endless opportunities to unlock new capabilities.

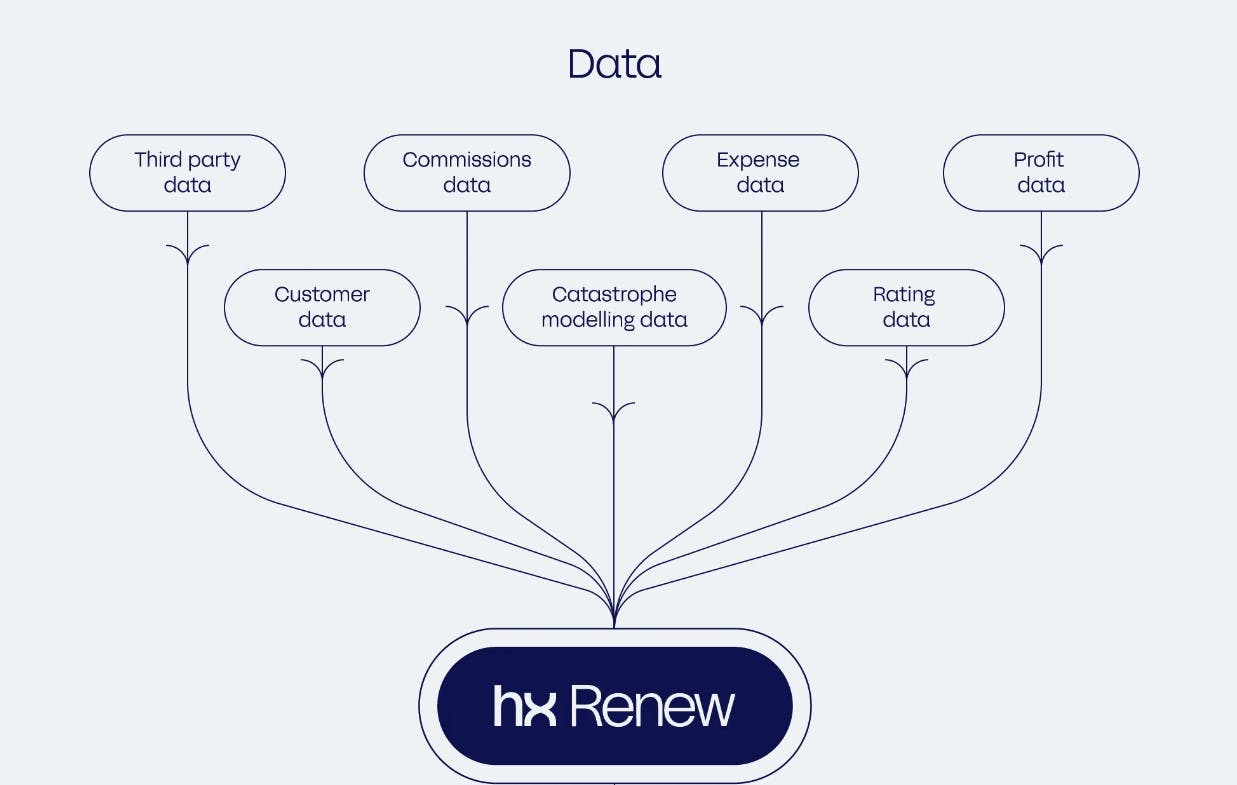

2. Better data driven decision making at the individual risk and portfolio level

Reporting with traditional pricing tools is a manual, time-consuming process. Data is often out of date by the time it is produced. Most insurance companies rely on quarterly reporting to understand their portfolio mix, assess exposures, and monitor rate change.

This has impacts throughout the pricing process, including underwriting workflows. Delayed or limited data and reporting results in less informed underwriting. Strategies can be slow to respond to changes, chipping away at your competitive edge.

Rich data exists, even if it has previously gone uncaptured—structured and unstructured, internal and external. Every previous decision, every relevant entry from a third-party platform, has the potential to be pulled through to your pricing workflow.

The next step is ensuring this captured data is pulled into a tight, iterative feedback loop to drive increasingly informed decision-making.

Enabling portfolio underwriting with live data

With hx Renew, underwriters can view their live portfolio and assess the marginal impact of the policy they are pricing in real time. Real-time visibility of rate change for a renewal, impact on accumulation risk, and the projected loss ratio enable better decisions on the risks they are writing.

The impact of this is clearly recognized by underwriters themselves. In our recent Vision and Road of Underwriting 3.0 report, we asked underwriters how technology could best enhance their role. Including more relevant data in the risk selection/pricing process and improving access to real-time portfolio insights took the first and second spot.

81% of underwriters worry about transitioning to portfolio underwriting in the future. 44% fear skill inadequacy in the next 2-5 years. The solution is twofold; investing in training, and ensuring that the tools and platforms underwriters are using set them up for success. hx Renew facilitates this evolution by making portfolio oversight as intuitive and enriched as possible.

Reporting for management and strategic steering

Informed decision-making should be happening on an underwriter-by-underwriter, risk-by-risk basis. It’s also important to enable broader strategic direction and course correction through deep insight.

hx Renew enables management to regularly report on rate adequacy and maintain a consistent, global portfolio view of live policies across all lines of business. Through access to real-time reporting, executives can make data driven decisions to steer the business, ensuring alignment to plan and driving profitability.

3. Automated risk triaging

The quoting process takes up a significant amount of underwriter resource, particularly for HiLo (high volume, low premium) lines of business such as Professional Indemnity, Directors & Officers and General Aviation. Traditional workflows and tools make it almost impossible to identify how to prioritize risks and allocate resources in the most profitable way.

Machine learning for insurance

With hx Renew, large quote volumes can be automatically triaged with machine learning. Risks which fall out of appetite are immediately qualified out, and the ones within appetite are graded. This allows underwriters to focus where they are most impactful—those risks which add the most value and drive profitable growth for the company.

For George Murphy, Antares Pricing Manager, both the present-day benefits and the potential of hx Renew are clear. “We definitely see hx Renew providing us with the ability to triage risk and to take better decisions faster on how we model and price policies,” he explained.

“At present every policy, regardless of value, takes a similar time to price; with the ability to quickly compare data, we can assess risk faster and decide on an appropriate level of underwriter and pricing involvement. In-model MI will be key to this, enabling a more efficient, data driven underwriting approach”

4. Rapid and collaborative quote-to-bind workflows

All too often, each activity in the quote-to-bind process is siloed and slow. Pricing is separate from peer review, which is separate from referrals, which is separate from document management, and so on. The result is an inefficient, disjointed, and unauditable process which reduces the ability of an underwriter to trade efficiently with brokers.

To move from quote to bind as smoothly as possible, underwriters must be able to seamlessly collaborate on a risk with their peers, CUO, and management within their existing workflows.

Faster processes and stronger communication with hx Renew

hx Renew provides the ability to collaborate using a customer’s preferred communication tools (such as email, Teams and Slack.) An automated audit trail of review and approval cycles ensures compliance with company permissions and limits.

The result? Accelerated underwriter process from initial quote through to bind, saving up to 50% time and allowing the underwriter to respond to brokers faster than ever.

5. Regulatory compliance

Compliance with the latest regulations and policies is absolutely vital for insurers, but outdated or inadequate platforms make it challenging.

Controls built into the pricing workflow

Underwriting guidelines and authorities can be built directly into the hx Renew platform. Any updates to these standards can be applied instantly across every model.

This not only streamlines the workflow, but also ensures adherence to the latest regulatory standards and significantly reduces the risk of non-compliance. No need to track down locally saved, outdated versions of pricing models out of step with current policies!

Additionally, the integration of peer review functionalities directly into the platform reinforces the accuracy and reliability of the underwriting decisions.

Automated flagging

Automated flags can be set on risks that fall outside the current underwriting strategy or appetite. This helps underwriters focus on suitable risks and align with the company’s strategic objectives.

It’s time for smoother workflows, better decision-making, and stronger business outcomes

The underwriter of the future spends less time rekeying and more time making data-driven decisions—but to get there, you need the right pricing solution. Get in touch with our experts to learn what possibilities you can unlock with hx Renew.